Mortgage rates dropped due to the Federal Reserve lowering rates in response to COVID-19. Record low mortgage rates are expected to stay near all-time lows through 2020, at least according to Freddie Mac’s latest forecast published November 1, 2019.

When you decide to refinance, you’ll learn that there are a number of options available. These can affect how much you pay each month and over the term of the loan.

A 30-year fixed-rate mortgage is a loan with an interest rate that stays the same for the life of the loan—30 years. They are popular because their low-interest rates can reduce payments. This type of mortgage has closing costs that are higher than those on an adjustable-rate mortgage (ARM), but lower than those on other types of home loans.

So, What Impacts the Yield Rate?

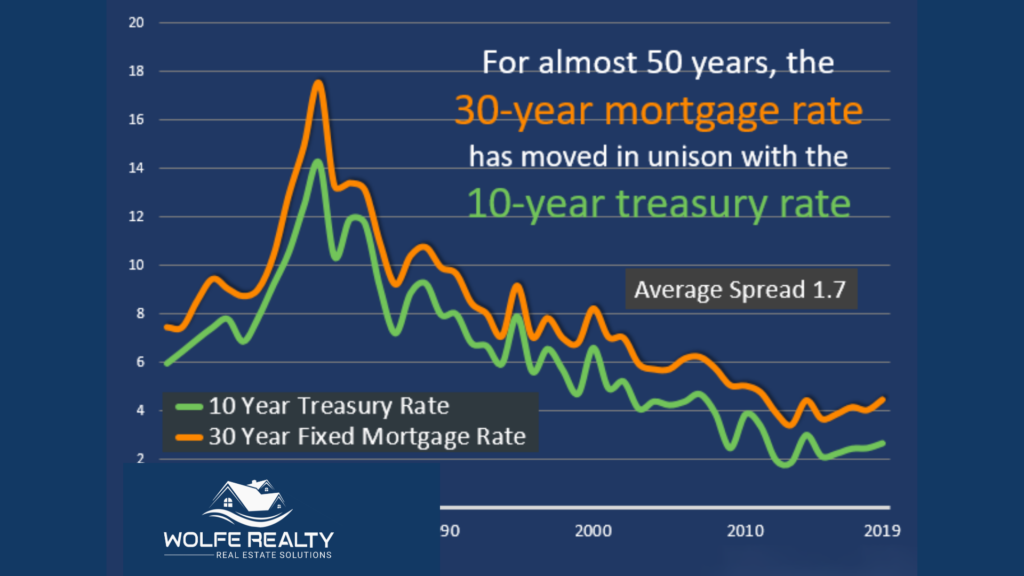

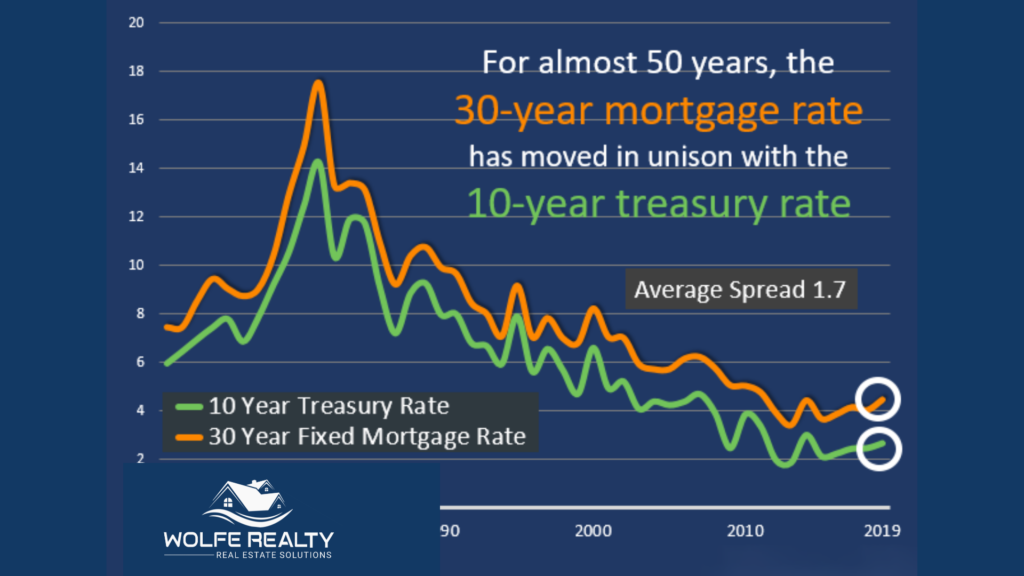

The 10-year Treasury yield is one of the most important economic indicators to track. It impacts nearly all other interest rates and helps determine mortgage rates, car loan rates, savings accounts interest rates, and so much more.

According to Investopedia:

“There are a number of economic factors that impact Treasury yields, such as interest rates, inflation, and economic growth.”

When the market is up there are concerns about inflation. The treasury yield increases in value since it serves as interest for the government. That increase affected mortgage rates.

What Does This Mean for You?

Khater, in the Freddie Mac release mentioned above, says:

“We expect mortgage rates to continue to rise modestly which will likely have an impact on home prices, causing them to moderate slightly after increasing over the last year.”

Nadia Evangelou, Senior Economist and Director of Forecasting for the National Association of Realtors (NAR), also addresses the issue:

“Consumers shouldn’t panic. Keep in mind that even though rates will increase in the following months, these rates will still be historically low. The National Association of REALTORS forecasts the 30-year fixed mortgage rate to reach 3.5% by mid-2022.”

Bottom Line

Forecasting mortgage rates is very difficult. As Mark Fleming, Chief Economist at First American once quipped:

“You know, the fallacy of economic forecasting is don’t ever try and forecast interest rates and or, more specifically, if you’re a real estate economist mortgage rates because you will always invariably be wrong.”

TAKE NOTE:

If you’re a first-time homebuyer or a current homeowner thinking of moving into a new house, be sure to follow mortgage rates. It may affect your decision.