Have you been considering buying a house instead of renting? It’s a tough decision—especially given the state of the economy. And, as a renter, you may be wondering if now is the right time to buy a home. In order to make an informed decision, you need to discuss several things with yourself and your family. Will it be easier to rent or buy? What are the advantages of each? Are there any disadvantages? Here are several things to consider so you can make the best decision possible on whether you should rent or buy.

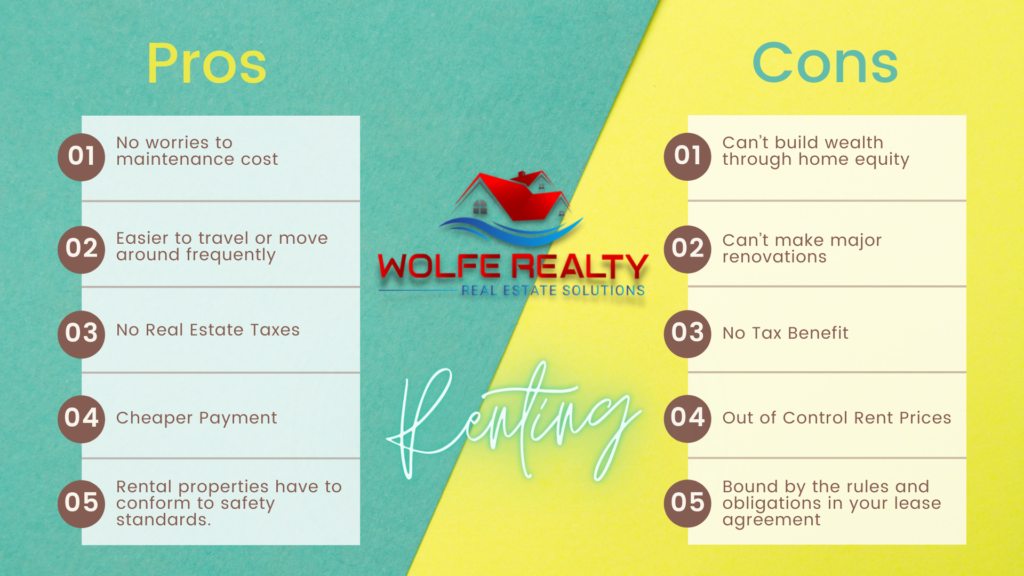

Pros and Cons of Renting

Renting has become the norm for many Americans. And with good reason. Renting is often less expensive than buying, especially if you don’t plan to own a home any time soon. It’s also easier to move around, which can be useful for people who change jobs or locations frequently.

Pros of renting

- You don’t have to worry about maintenance costs, whether the property will be worth more in 10 years, or whether you’ll ever recover your investment. If it doesn’t fit your needs or lifestyle, you can easily move on. You don’t have to deal with the hassle of moving day and dealing with landlords who aren’t happy with the changes you made.

Cons of renting

- While renting is easier than buying, you’re still tying up money that could be invested elsewhere. That’s money that could buy a house or other investments that will provide income down the road. For some people, this doesn’t matter as much as the flexibility of being able to live anywhere at any time they want. But if you’re concerned about keeping up with rising real estate prices and paying for large mortgages, renting may not be right for you.

Pros and Cons of Homebuying

Homebuying is not an easy decision for most people. It is a big commitment and it can be stressful at times. But with the right knowledge, you can make the process much easier. Here are some of the cons and pros of buying a home, both in terms of finances and practicalities.

Pros of Homebuying

- Homeownership is typically tax-free, which means more money in your pocket.

- Having your own home can help you achieve financial security, which makes it easier to get out of debt. foreclosure rates are typically lower among owners than renters.

- Owning a home gives an individual greater flexibility in how they can use their money. They can move money around between their checking account and investments without penalty, or they can take yearly vacations or buy fancy clothes without having to worry about having enough cash on hand to cover living expenses while they’re away.

Cons of Homebuying

- Mortgage payments are typically higher than rent payments (although many people receive tax benefits that offset some of that difference). If you don’t have enough money saved up to pay the mortgage on time every month, you’ll end up paying more interest overall by not making regular payments as you should. This is why it’s important to save some money each month before deciding to buy a home (or wait until you’ve saved up enough for a down payment). You might also want to consider renting for some period of time before buying so that you can afford the loan payments without putting yourself into too much debt early on.

The best time to buy a house is when you can afford it. If you’re financially stable, the best time to buy is when you have the resources to pay for your down payment and closing costs. That means you should have enough savings to cover at least 20% of the purchase price of the house, including mortgage and property taxes, insurance, and maintenance.